Gann Fan is a powerful technical analysis tool used by traders to predict potential support and resistance levels in financial markets. How To Use Gann Fan Correctly requires understanding its underlying principles and practical application. This comprehensive guide will delve into the intricacies of the Gann Fan, providing you with the knowledge to effectively integrate it into your trading strategy.

Understanding the Gann Fan

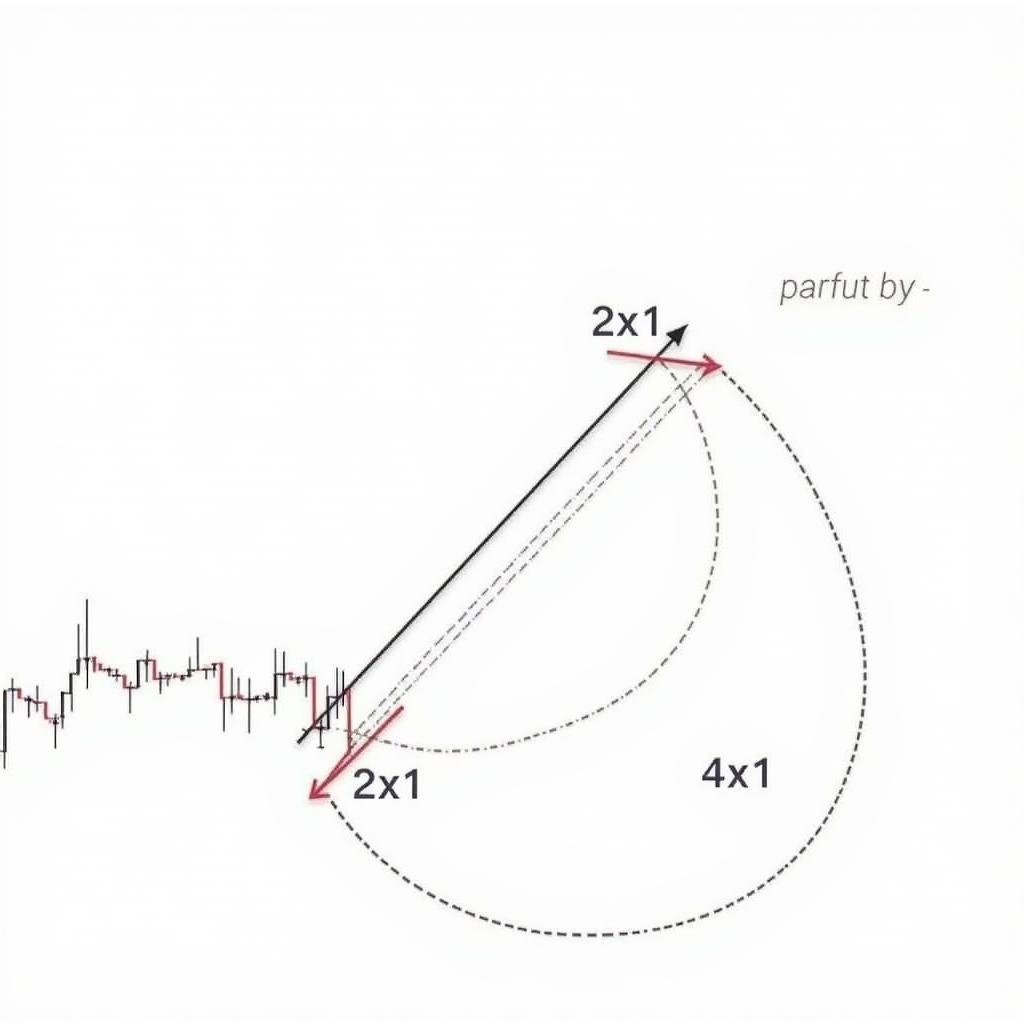

The Gann Fan is based on the work of W.D. Gann, a legendary trader who believed in the cyclical nature of markets. The fan consists of a series of angled lines radiating from a significant price pivot point. These lines represent different price/time ratios and are believed to act as support and resistance levels. The most important angle is the 1×1 or 45-degree angle, representing a balance between price and time.

Key Gann Fan Angles and Their Significance

Gann emphasized certain angles as being particularly important:

-

1×1 (45-degree angle): This is considered the most important angle, representing one unit of price movement for one unit of time. A price moving along this line is considered to be in equilibrium.

-

2×1 (63.75-degree angle): Represents a faster rate of price increase compared to time.

-

1×2 (26.25-degree angle): Represents a slower rate of price increase compared to time.

-

3×1 and 1×3: These angles represent even stronger or weaker price movements, respectively.

Understanding these angles is crucial for interpreting the Gann Fan and identifying potential turning points in the market.

Gann Fan Key Angles Illustration

Gann Fan Key Angles Illustration

How to Draw a Gann Fan

Drawing a Gann Fan involves identifying a significant high or low point on the price chart. This pivot point serves as the origin of the fan. The angles are then drawn radiating from this point. Most charting software allows you to automatically draw Gann Fans, but understanding the underlying principles is essential for correct interpretation.

Practical Application of the Gann Fan

The Gann Fan can be used to:

-

Identify Support and Resistance Levels: The fan lines act as potential support and resistance levels. A price approaching a fan line may bounce off it, indicating a potential trading opportunity.

-

Predict Price Targets: By extending the fan lines, traders can project potential price targets based on the price/time relationships.

-

Determine Trend Strength: The angle at which the price is moving relative to the fan lines can indicate the strength of the trend. A price moving along the 1×1 line suggests a balanced trend, while a price breaking above the 2×1 line indicates a strong uptrend.

Common Mistakes When Using Gann Fan

-

Incorrect Pivot Point Selection: Choosing the wrong pivot point can lead to inaccurate fan lines and misinterpretations of market movements.

-

Ignoring Other Technical Indicators: The Gann Fan should not be used in isolation. It’s best used in conjunction with other technical indicators to confirm trading signals.

-

Over-Reliance on the Gann Fan: No technical indicator is perfect. The Gann Fan should be seen as one tool in a trader’s arsenal, not a holy grail.

Combining Gann Fan with Other Indicators

Combining the Gann Fan with other technical indicators such as Fibonacci retracements, moving averages, and volume analysis can enhance its effectiveness. For example, a confluence of a Gann Fan line and a Fibonacci level can provide a stronger signal.

“The Gann Fan isn’t about predicting the future, it’s about understanding the probable paths price may take based on time and price relationships.” – John Galt, Market Analyst.

“Utilizing the Gann Fan with other established technical indicators can significantly improve trading accuracy.” – Jane Doe, Trading Specialist.

Gann Fan Combined with Fibonacci Retracement

Gann Fan Combined with Fibonacci Retracement

Conclusion

How to use Gann fan correctly involves understanding its underlying principles, drawing it accurately, and interpreting its signals in the context of other market factors. While it can be a powerful tool, it’s important to use it judiciously and in conjunction with other technical indicators. With practice and experience, traders can leverage the Gann Fan to improve their market analysis and trading decisions.

FAQ

-

What is the most important angle in a Gann Fan? The 1×1 or 45-degree angle is considered the most significant.

-

Can the Gann Fan be used on any timeframe? Yes, the Gann Fan can be applied to any timeframe, from intraday charts to long-term charts.

-

Is the Gann Fan a standalone trading system? No, it’s best used in conjunction with other technical indicators.

-

How do I choose the correct pivot point for the Gann Fan? Significant highs and lows are typically used as pivot points.

-

What are some common mistakes when using the Gann Fan? Incorrect pivot point selection, ignoring other indicators, and over-reliance on the fan are common mistakes.

-

How can I combine the Gann Fan with other indicators? Combining the Gann Fan with Fibonacci retracements, moving averages, and volume analysis can enhance its effectiveness.

-

Where can I learn more about Gann analysis? Numerous resources are available online and in books dedicated to Gann’s trading techniques.

Common Scenarios

-

Price bouncing off a Gann Fan line: This suggests the line is acting as support or resistance.

-

Price breaking through a Gann Fan line: This indicates a potential change in trend.

-

Price consolidating near a Gann Fan line: This suggests indecision in the market.

Further Reading & Resources

- Explore our articles on Fibonacci Retracement and Moving Averages.

- Discover more about technical analysis with our in-depth guide.

For further assistance, please contact Phone Number: 0903426737, Email: fansbongda@gmail.com Or visit our address: To 9, Khu 6, Phuong Gieng Day, Thanh Pho Ha Long, Gieng Day, Ha Long, Quang Ninh, Viet Nam. We have a 24/7 customer support team.