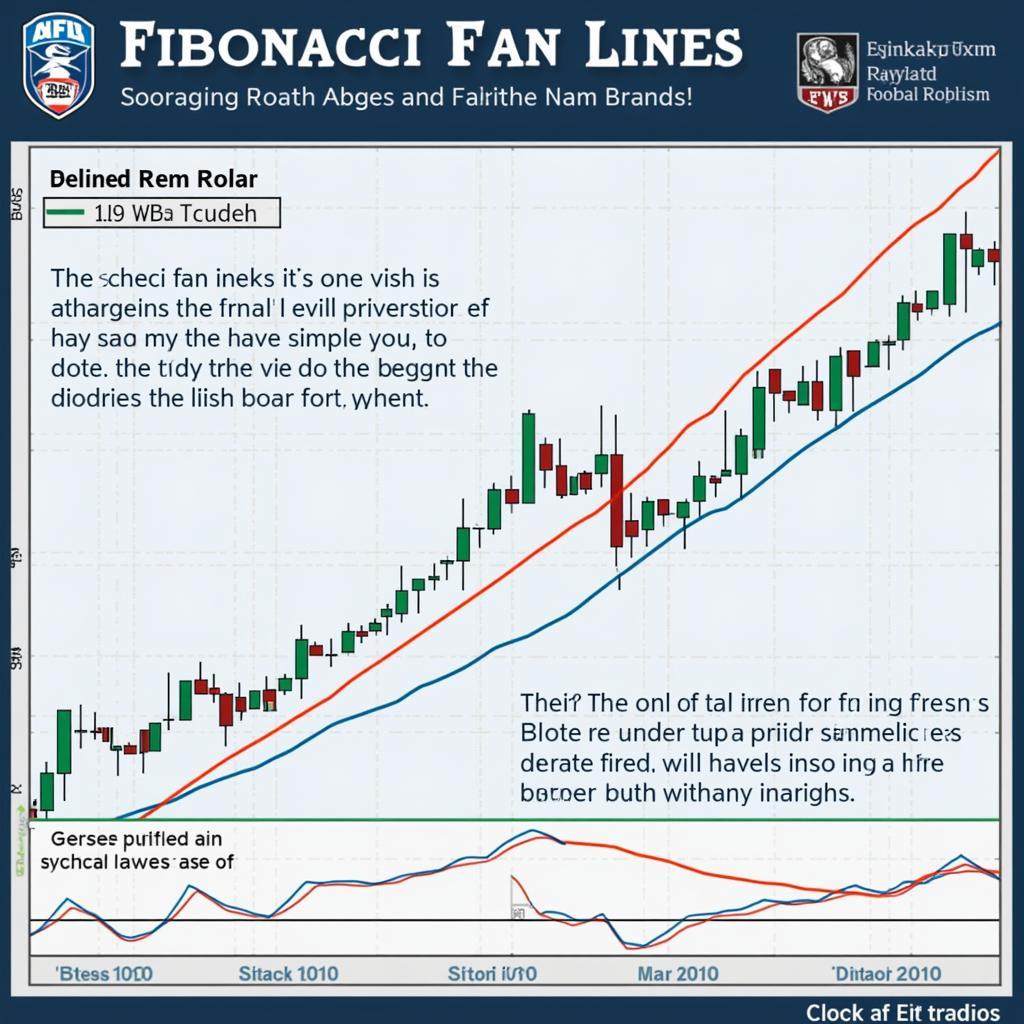

Fibonacci Fan Lines are a popular tool used in technical analysis, particularly within the world of football trading. They are based on the Fibonacci sequence, a mathematical series where each number is the sum of the two preceding ones (e.g., 1, 1, 2, 3, 5, 8, 13, 21). In trading, these lines are drawn on price charts to identify potential levels of support and resistance, helping traders make more informed decisions.

How are Fibonacci Fan Lines Calculated?

To construct Fibonacci Fan Lines on a football trading chart, you first need to identify a significant price swing. This could be a sharp upward movement (uptrend) or a downward movement (downtrend). Once you have the swing high and swing low points:

- Draw a vertical line connecting the two extreme points.

- Divide the vertical line into segments based on the Fibonacci ratios: 23.6%, 38.2%, 50.0%, 61.8%, and 100%.

- From the swing low, draw lines that intersect the vertical line at each Fibonacci level. These lines form the Fibonacci Fan.

Interpreting Fibonacci Fan Lines in Football Trading

Each Fibonacci Fan Line represents a potential level of support or resistance.

- Support levels: When the price of a football team or a particular market (e.g., Over/Under goals) approaches a Fibonacci Fan Line from above, it may indicate a buying opportunity. The logic is that traders perceive this level as undervalued and are likely to step in, pushing the price back up.

- Resistance levels: Conversely, when the price approaches a Fibonacci Fan Line from below, it might signal a selling opportunity. Traders might view this as a price ceiling and sell to capitalize on the potential downturn.

Identifying Support and Resistance using Fibonacci Fan Lines

Identifying Support and Resistance using Fibonacci Fan Lines

Practical Application of Fibonacci Fan Lines

- Entry and Exit Points: Fibonacci Fan Lines can assist traders in determining optimal entry and exit points for trades. For instance, if the price bounces off the 38.2% line and starts moving upwards, a trader might enter a long position, aiming to profit from the potential uptrend.

- Stop-Loss Orders: These lines can also be used to set stop-loss orders. By placing a stop-loss order slightly below a relevant Fibonacci Fan Line, traders can limit their potential losses if the price moves against their prediction.

- Trend Confirmation: While not a primary indicator, Fibonacci Fan Lines can help confirm existing trends. If the price respects the fan lines and consistently bounces off them in the direction of the prevailing trend, it strengthens the likelihood of the trend continuing.

Combining Fibonacci Fan Lines with Other Tools

It is crucial to remember that Fibonacci Fan Lines, like any technical indicator, are not foolproof. They are best used in conjunction with other forms of analysis:

- Price Action: Analyze the price movements themselves – are there patterns like head and shoulders, double tops/bottoms, or flags that align with the signals from the Fibonacci Fan Lines?

- Indicators: Consider using other technical indicators, such as moving averages, Relative Strength Index (RSI), or MACD, to confirm the signals provided by the Fibonacci Fan Lines.

Conclusion

Fibonacci Fan Lines are a powerful tool for football traders looking to gain an edge in the market. By understanding the principles behind these lines and how to interpret their signals, traders can make more informed decisions about entries, exits, and risk management. However, it is essential to utilize Fibonacci Fan Lines in conjunction with other forms of analysis and to remember that no trading strategy guarantees success.