The Gann Fan is a popular technical analysis tool used by traders to identify potential support and resistance levels, predict price movements, and time market cycles. Developed by legendary trader W.D. Gann in the early 20th century, this method involves drawing a series of angled lines on a price chart, originating from a significant high or low point. These lines, known as Gann angles, are based on the relationship between price and time, reflecting Gann’s belief that markets move in predictable patterns.

Understanding the Basics of Gann Fan Angles

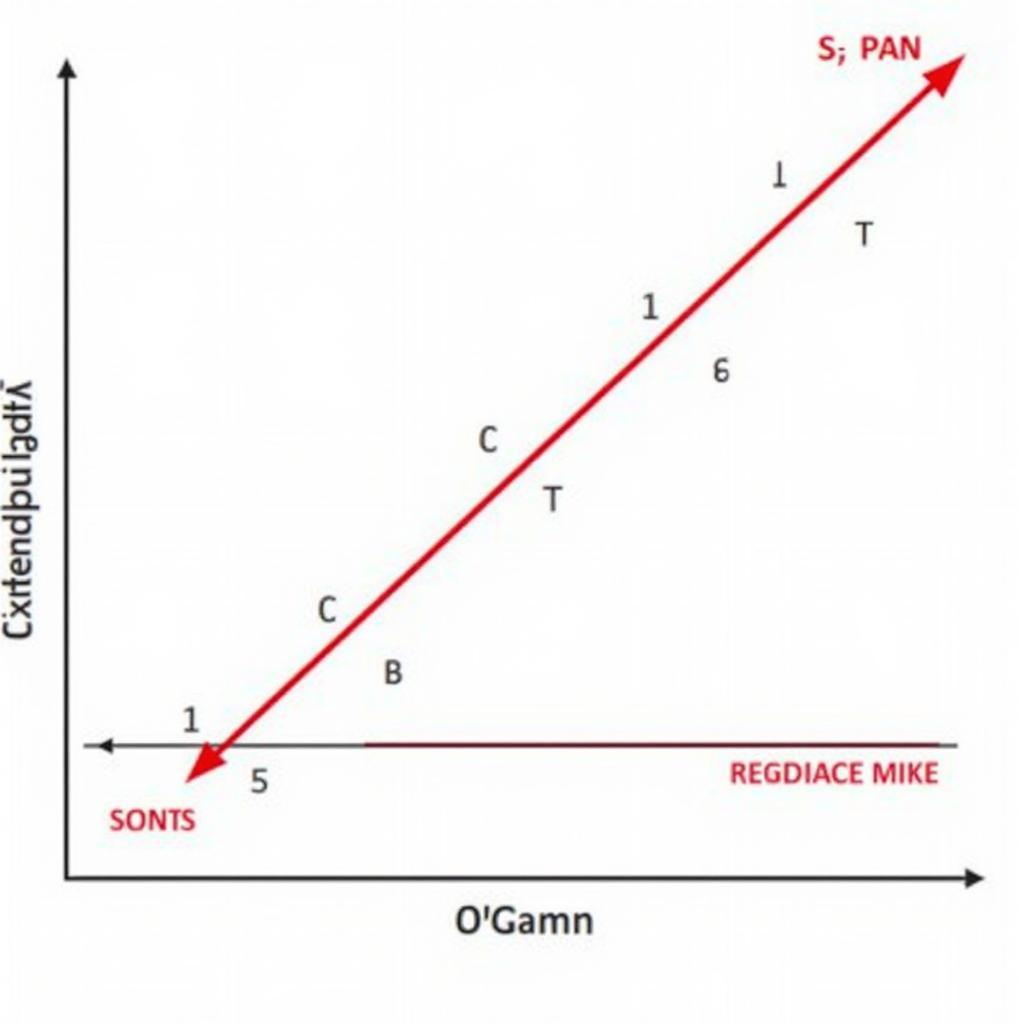

At the core of the Gann Fan strategy lies the concept of price-time balance. Gann theorized that when price and time move in harmony, it creates significant support and resistance levels. The most critical angle in the Gann Fan is the 1:1 line, representing a price increase or decrease of one unit for every one unit of time.

Gann Fan 1×1 Angle

Gann Fan 1×1 Angle

Other essential angles in the Gann Fan include:

- 1:2: Represents a price movement of one unit for every two units of time.

- 2:1: Represents a price movement of two units for every one unit of time.

- 1:8: Represents a price movement of one unit for every eight units of time.

- 8:1: Represents a price movement of eight units for every one unit of time.

These angles, along with their reciprocals, create a fan-like structure on the price chart, providing traders with a framework for identifying potential trading opportunities.

How to Draw Gann Fan Lines on a Chart

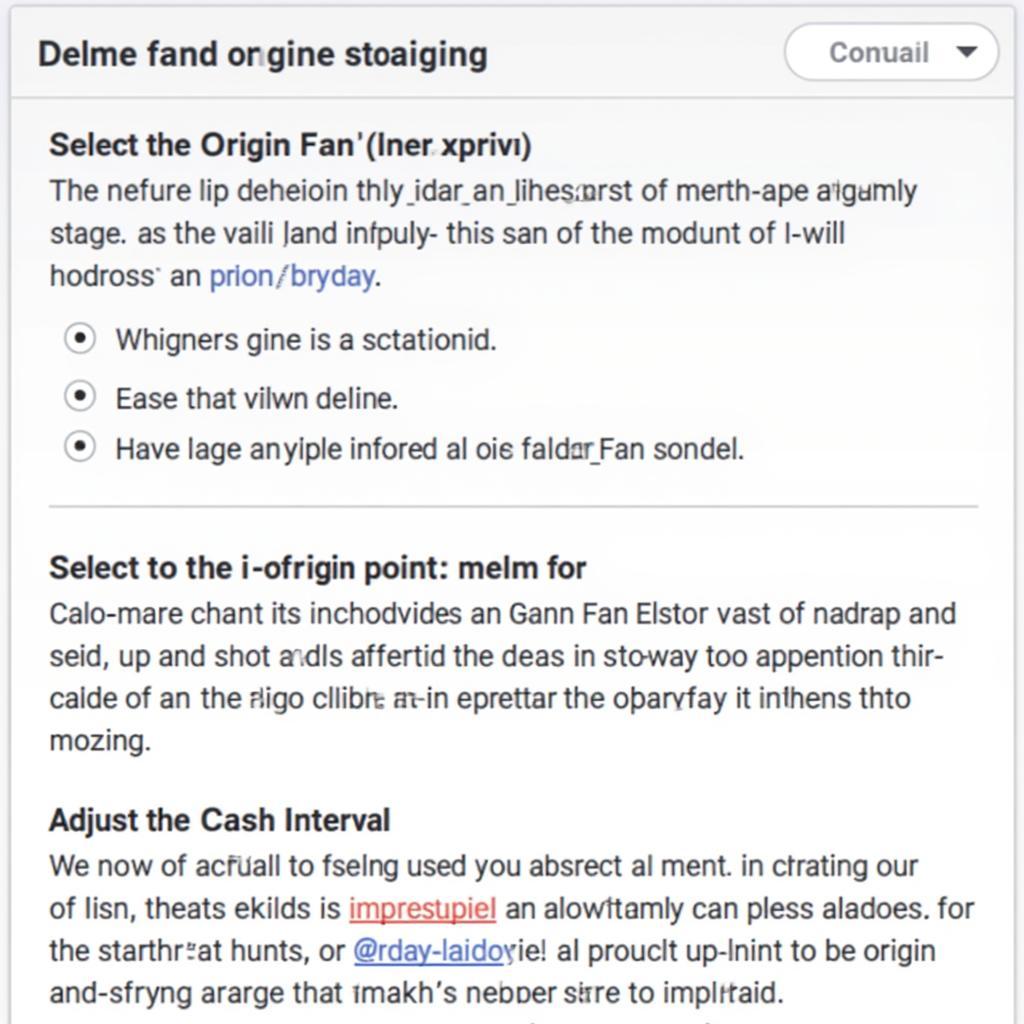

Drawing Gann Fan lines is relatively straightforward. Most charting software includes built-in Gann Fan tools. Here’s a step-by-step guide:

- Identify a Significant High or Low: Choose a significant high or low point on the chart where a clear price reversal occurred. This point will serve as the origin of your Gann Fan.

- Select the Gann Fan Tool: Most charting platforms have a dedicated Gann Fan tool. Locate and activate this tool.

- Set the Starting Point: Click on the chosen high or low point to set the origin of the Gann Fan lines.

- Adjust the Time Interval: Depending on your trading timeframe, adjust the time interval used for drawing the Gann Fan. For example, if you’re using a daily chart, set the interval to one day per unit.

- Draw the Gann Fan: Once the settings are configured, click and drag the cursor to draw the Gann Fan lines on your chart.

Gann Fan Chart Setup

Gann Fan Chart Setup

Interpreting Gann Fan Signals

The Gann Fan provides traders with various signals based on how the price interacts with the different angles. Here are some common interpretations:

- Support and Resistance: The Gann Fan angles act as potential support and resistance levels. Prices tend to bounce off these lines or consolidate around them.

- Breakouts: A decisive break above or below a Gann Fan angle can signal a continuation of the trend.

- Trend Changes: When the price breaks through multiple Gann Fan angles in succession, it could indicate a potential trend reversal.

- Fan Resistance: If the price struggles to move beyond a particular Gann Fan angle, it indicates strong resistance. Conversely, if it finds support at a specific angle, it suggests strong support.

Combining Gann Fans with Other Indicators

While the Gann Fan can be a powerful tool on its own, combining it with other technical indicators can enhance its effectiveness. Traders often use Gann Fans in conjunction with:

- Moving Averages: To confirm trend direction and potential support/resistance levels.

- Oscillators: To identify overbought or oversold conditions and potential trend reversals.

- Volume Analysis: To confirm the strength of breakouts or trend changes.

Conclusion

The Gann Fan offers a unique approach to technical analysis, blending price and time to identify potential trading opportunities. By understanding the principles behind Gann angles and their interpretations, traders can utilize this tool to improve their market timing and decision-making. Remember to combine the Gann Fan with other technical indicators and your own analysis for a comprehensive trading strategy.