Using the Fibonacci Fan tool on TradingView can be a powerful way to identify potential support and resistance levels, predict price movements, and enhance your trading strategy. This guide will provide a comprehensive overview of how to utilize this valuable tool effectively.

Understanding the Fibonacci Fan

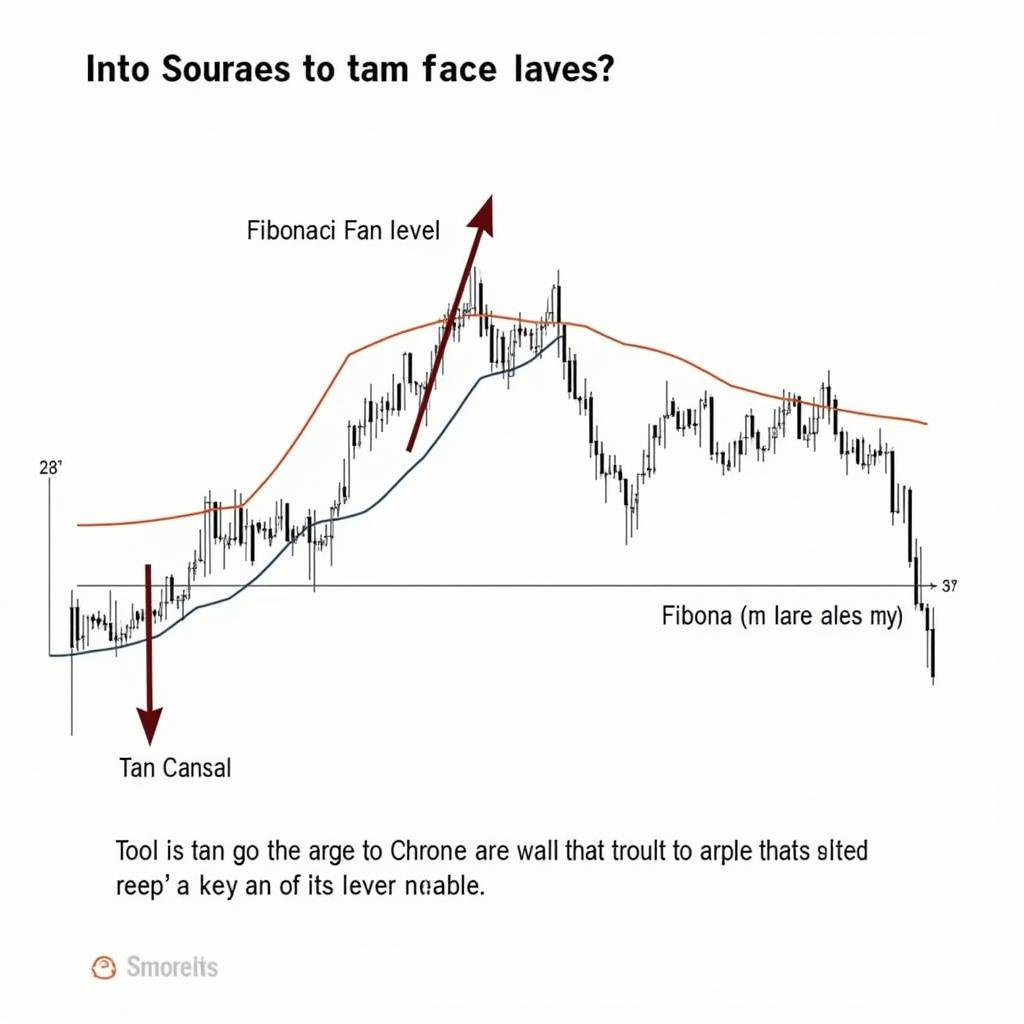

The Fibonacci Fan is a drawing tool based on the Fibonacci sequence, a mathematical series where each number is the sum of the two preceding ones (e.g., 1, 1, 2, 3, 5, 8). On TradingView, the Fibonacci Fan is constructed by drawing a trendline between two significant price points (a swing high and a swing low, or vice versa). The tool then projects three trendlines at 38.2%, 50%, and 61.8% angles, representing potential areas where price might find support or resistance.

How to Use the Fibonacci Fan on TradingView

Applying the Fibonacci Fan on TradingView is straightforward. First, identify the two significant swing points that define the trend. Click on the Fibonacci Fan tool in the left-hand toolbar and then click on the starting point of your trendline, dragging it to the ending point. TradingView will automatically generate the fan lines.

Interpreting Fibonacci Fan Levels

The 38.2%, 50%, and 61.8% lines represent potential support and resistance levels. When the price approaches one of these lines, it might bounce off it (finding support or encountering resistance). These levels can be used to identify potential entry and exit points. For example, if the price bounces off the 38.2% line during an uptrend, it could be a buying opportunity. Conversely, if the price breaks through the 61.8% line during a downtrend, it could signal a continuation of the downward movement.

Combining Fibonacci Fan with Other Indicators

For a more robust analysis, consider combining the Fibonacci Fan with other technical indicators, such as moving averages, RSI, or MACD. This can help confirm potential trading signals and improve the accuracy of your predictions. For instance, if the price reaches a Fibonacci Fan level and the RSI shows an oversold condition, it might indicate a strong buying opportunity.

Practical Examples and Strategies

Let’s consider a practical example. Suppose the price of a stock is in an uptrend. You draw a Fibonacci Fan from a swing low to a swing high. As the price rises, it encounters the 38.2% fan line. If the price bounces off this line and other indicators confirm a potential reversal, you might consider entering a long position.

Another example is using the Fibonacci Fan to set stop-loss orders. If you enter a long position near the 38.2% line, you might set your stop-loss just below the previous swing low. This can help limit your potential losses if the price moves against your position.

Limitations of the Fibonacci Fan

While the Fibonacci Fan can be a valuable tool, it’s essential to remember its limitations. It’s not a foolproof system, and prices don’t always respect Fibonacci levels. It’s crucial to combine the Fibonacci Fan with other indicators and sound risk management practices.

Understanding the Limitations of Fibonacci Fan

Understanding the Limitations of Fibonacci Fan

Conclusion

Mastering the Fibonacci Fan on TradingView can be a valuable addition to your trading toolkit. By understanding how to apply, interpret, and combine this tool with other indicators, you can improve your ability to identify potential support and resistance levels and enhance your overall trading strategy. Remember to practice using the tool and combine it with other analysis methods for best results. Remember, successful trading requires continuous learning and adaptation.

FAQ

- What is the Fibonacci sequence?

- How do I draw a Fibonacci Fan on TradingView?

- What are the key Fibonacci Fan levels?

- How can I combine the Fibonacci Fan with other indicators?

- What are the limitations of the Fibonacci Fan?

- Can I use the Fibonacci Fan for day trading?

- How can I practice using the Fibonacci Fan?

Common Scenarios and Questions

- Scenario: Price breaks through a Fibonacci Fan level. Question: What should I do?

- Scenario: Multiple Fibonacci Fan levels converge. Question: How do I interpret this?

Further Resources

Explore more articles on technical analysis and trading strategies on our website.

Need Help?

Contact us at Phone Number: 0903426737, Email: [email protected] or visit us at Address: Tổ 9, Khu 6, Phường Giếng Đáy, Thành Phố Hạ Long, Giếng Đáy, Hạ Long, Quảng Ninh, Việt Nam. Our customer service team is available 24/7.